Beyond the Numbers:

Single mothers battling the Cost of Living Crisis

The cost of living crisis in the UK has reached unprecedented levels, leaving countless individuals and households affected by financial instability. In the wake of this crisis, single mothers throughout the country are finding themselves shouldering an immense burden, navigating through a relentless storm of rising expenses and dwindling resources. The numbers speak for themselves - painting a stark picture of the struggles of this particular demographic.

According to the Office of National Statistics (ONS), approximately 3 Million households are headed by just one parent, accounting for 15.4% of the British population. A staggering 90% of these single-parent families are headed by women. Behind this concerning statistic lies a painful reality: single mothers are disproportionately affected by the rising cost of living - plunging them into a vicious cycle of financial instability and dwindling resources.

These are the stories of resilient single mothers who are often overlooked and underserved.

I could not find a place to live, until I lied

Initially, Carly did not fully understand the extent of the cost of living crisis. The mother of a four-year-old thought her financial squeeze was a result of her personal failings - a narrative that is deep-rooted within the subconscious of today’s capitalistic society. “It felt like somehow it was all my fault that I'm a single parent and all of those things because these are the messages that society throws at us. So even on a conscious level, I know these things are not true, it is still kind of embedded in us because that's how we are conditioned,” says Carly during our conversation. According to her, it was not until the mainstream media shed some light on the struggles of single parents in the cost of living crisis that she realised she was not alone in facing such hurdles. Instead, her experience was actually part of a larger problem faced by the single-parent demographic. Gradually, the rising expenses and bills along with the responsibilities of a single parent began to weigh heavily on her shoulders.

During the Covid-19 pandemic, while things were tight for most people, Carly found a small window to breathe. Her expenses took a turnaround as she did not have to go out much. She was already on Universal Credit at that time, and during the lockdown, her Universal Credit amount increased by almost £100. It was unnecessary for her, she stated, as her expenses were down already. However, as the pandemic abated, the government abruptly halted this additional assistance, leaving Carly in a dilemma. “It was a huge deal for me when they took it away. They gave me an increase during the pandemic when I was not in need. And then when the pandemic ended, they just stopped. Anytime you have to adjust to less money is really challenging.”

After the pandemic, Carly had to go back to her job which only meant her expenses would increase. One of the most significant challenges single mothers face living in the British capital is the exorbitant price of childcare. Most mothers work multiple shifts to earn money and sustain their living. In most cases, the more time they spend going out to work, the more money they have to pay for childcare since there is no one else to look after the young children.

Carly’s story was no different. When her son was small, she worked part-time and had to put him in childcare which cost her almost £1000 per month. This is equivalent to an average rental price in some areas of London. Of course, Carly had Universal Credit to back her up, but it was capped at 85% towards childcare. She also spoke about how both of her parents still had to work full-time - despite them being on the verge of retirement, just so they could manage all the expenses. This also meant that Carly could not rely on her parents for taking care of her son and that putting her son in childcare was her last resort.

At that same time, Carly was paying roughly £1300 per month towards private renting which increased the financial burden even more. So essentially, her outgoings for a month were above £2000, which was significantly more than what she earned from her job. Even before paying her bills and calculating her basic expenses, she was in debt. Carly recalled the time when she had to pay the upfront fees for her son’s nursery and private renting. She did not have enough money to cover all of this, so she had to rely heavily on Universal Credit. Her situation got even worse when she had to face a delay of over 10 weeks before she could receive her sum from Universal Credit.

She applied for an advance loan from the Universal Credit Department, which she received. But that only meant that now she had to pay it back every month out of her monthly Universal Credit amount, which came off as a burden. “There is a 5-week delay before you get your final amount. They messed up mine, so I had double, I had a 10-week wait. I had no way of paying these upfront fees. I had to borrow the money from Universal Credit. They give you an advance, but you then pay that back out of your monthly allowance. Each month the amount that I received was less than what I was owed - about £100 or more because I was paying back these advances that I had to use for my upfront fees.”

Carly also spoke about how she had a hard time managing the pay dates for all these expensive outgoings. Her son’s nursery fees came out on the 1st, her rent used to get due on the 5th, and her salary was credited on the 23rd of every month. “I couldn't cover both my nursery and my rent before I got my Universal Credit on the 8th. So I asked if my nursery fee date could be changed. No. Can my rent day be changed? No. And so I went to Universal Credit and I said, can I change my date because my payments are coming out soon? No. So then you're in this cycle of trying to catch up all the time, getting advances, having to pay that advance.”

She added: “It was crazy! I was just forming a relationship with my son’s nursery at that point, and I did not know what they were going to do. If I do not pay my fees, will they not accept my child? So I decided to pay for my childcare on time, and then I asked my landlord if I could pay my rent three days later. Yes, she said. However, the agency that I did it through said no. We had this informal agreement that I would pay my rent late and I would get these reminders, but I could just ignore them and pay my rent late. I do not know if that impacted my credit score. It was something that I just could not think about because I had to make a hit somewhere.”

After paying all the bills, Carly used to have around £500 left in her account for her and her child’s basic necessities. “It might sound like a lot, but it's not when you are living in London and you have a five-year-old.” Limited money in her savings account had often made Carly conscious about her spending choices. She spoke about how she started to hate going shopping, and how it used to make her feel anxious. She addressed how eating healthy and fresh food can be expensive and is seen as a privilege when it should be a basic thing for every human.

“I should just be able to buy fresh fruits and vegetables, but I often found myself with loaded feelings about it.” At times when Carly ran out of fresh food and groceries midweek, she had to put a lot of thought into whether she should top things up or not. “And then, if I chose not to top things up in the middle of the week, then we used to start snacking on unhealthy alternatives like slices of bread, or things that are cheaper.”

I asked Carly about her housing situation, and how difficult it was for her to get into private renting in London, especially amidst the ongoing housing crisis. It was not her first choice to get into private renting. She was living comfortably with her parents in a council home until she and her son ultimately outgrew the space. She requested the council to give her a new space enough for both mother and son. However, they desperately pushed her into private renting. As a single mother, Carly described that she faced intense discrimination while hunting for a place to live. All the estate agents and private renting companies turned her down because of her single-mother status. “They would ask me: How many bedrooms? What's your partner's income? You don’t have a partner? Who is it for? So they did not even get to my income. They would ask, “Who is it for?” And when I replied me and my son, their answer would always be: no, there need to be two employed people to rent.”

It was a horrific experience for her - the fact that they did not even bother to know about her income status and just denied her upfront. Most landlords do not want to let their places to someone relying on Universal Credit. Carly encountered similar experiences, where she was continuously denied because of her dependency on Universal Credit. She finally managed to get a viewing with a female landlord, who herself was a single mother at one point. But ironically, even she did not want any tenants depending on Universal Credit. After all this struggle, Carly decided to lie and say she is not on Universal Credit. She ended up getting the apartment but had to put up both her parents as guarantors on paper - all because she was a single mother.

Carly’s experience with housing goes far beyond the equation of numbers and economics. She had to face sheer discrimination because of her single mother status. Not once or twice, but repeatedly. Her everyday struggles serve as an example of resilience and sacrifice while giving poignant reminders of the challenges that single mothers face in the wake of the cost of living crisis. She was fortunate to have a fairly well-paying job and full-time working parents who backed her up at desperate times.

However, I wonder about those less fortunate.

I was better off financially before I had children

51-year-old Emma has been a single mother for more than a decade now. After separating from her husband, Emma has been taking care of both her children by herself. When her children were younger, she used to work part-time as a clinical psychologist for the NHS. She was unable to progress her career and move forward with working full-time because she had two young lives solely dependent on her.

Trying to maintain a balance between her professional life and taking care of her two sons is something that Emma has had to perfect with every step of the way. “Sick leave for the kids and being called to the school in the middle of work when one of them was ill are the kind of things that I think tend to fall on the mother very often. They never rang my ex-husband to say he needed to pick them up. He works two hours away. So it was always me,” said Emma while pointing out one of the most common troubles at the very base of what seems like an entire mountain of things that a single mother must overcome. All single mothers are expected and almost forced to maintain such an exhausting and mentally straining lifestyle while receiving little support.

In this day and age, financial stability is imperative. Enough importance can never be placed on the financial stability required to raise children, especially in an expensive city like Brighton. While other parents may not find it as difficult because they have a significant other to rely on and work together with, it is an entirely different story when it comes to single parents, especially single mothers.

Even though her ex-husband has remained in touch and connected with them, all the big responsibilities have been solely for Emma to bear. Like many single mothers, she had to sacrifice her senior position and work part-time during her children’s initial years, which impacted her earning capacity. She has even noticed that instead of progressing or at least staying consistent, her earnings have only kept being hit because of reasons that are not at all uncommon - an increase in the cost of living, mortgage, education of children, and so on. Even though she is working full-time now, the static wages and cost of living crisis have gradually decreased the value of her salary. These are probably the worst cards that can be dealt to single mothers trying to cope with the financial pressures.

During the Covid-19 pandemic, Emma, unfortunately, suffered a heart attack. Not only did it take a toll on her physical and mental health, but also on her finances. “I had to use the last of my little bit of savings and all sorts of things. And those are the kind of unexpected things that you just don't have a cushion to manage when you are on your own, I think. It is quite hard.” Single mothers cannot be prepared for such situations as they are barely getting by each month with nearly zero savings. While she is able to pay for all the things labelled as requirements, she is not left with any money to buy anything other than the necessities, or to pay for any unexpected repairs and similar expenses.

Seeing her acquaintances or even strangers with families having two adults leaves her wondering about the places or vacations they may go on with their kids, things that she, or any single mother, cannot think about easily. At the back of their minds, these women always worry about carefully allocating their limited funds among the essentials. What may be emotional spending for others, ends up being a huge waste of precious money for these single mothers as they would rather spend more wisely towards essentials or save it for a rainy day.

Amidst the housing crisis in the UK, buying a house or even just renting one can be pretty heavy on your wallet, especially with no rental regulations. Things like hikes in mortgage rates can further affect any normal family, let alone single mothers. Emma claims to have experienced the same. “I had a fixed rate mortgage, so I was on a reasonable rate and I could afford it. That's going to go up by a couple of hundred pounds a month in the autumn.” On top of her incredibly high energy bills and increasing food costs, this was another issue added to the list of things that brought on anxiety and psychological distress. These women try and try their best to overcome one hurdle just to come face-to-face with yet another one.

Another major setback for women in the same shoes as Emma is the childcare benefit. The combined income of couples is naturally more than what a single parent earns. For instance, a couple earns a hundred thousand pounds together. Though their combined income is much more, their individual income might be just below the threshold of childcare allowance. So, receiving the childcare benefit on top of that income only adds extra financial support. However, for single mothers who are earning half of that amount, a bit above the threshold and they end up losing it and childcare benefit does not really prove to be much of a benefit at all.

“We are penalised for being on our own by a lot of the benefits as well. I think there is a real blind spot from the government to single parents.” It defeats the purpose of implementing policies made to aid the people bereft of any support if they do not reach the ones who need their help the most.

Even though they are single parents, these women fail to get any benefits because they are earning just enough to not be able to claim anything. When Emma was a part-time worker and her income was lower, she was able to benefit from the government's policies such as the Universal Credit supplement. Now that she has been working full-time with the NHS as a clinical psychologist, her salary is just sufficient to get by. Such government policies prove to be useless for her and she sometimes still has to get a bit of help from ‘green charities’ where she can get her groceries for much cheaper prices to cover for any extra expenses incurred. These charities do not have any requirements for claiming the benefits either.

Emma is lucky enough that her ex-husband pays child maintenance. However, that is not the case for others. The single parent often gets left behind with nothing by the absent parent and in Emma’s opinion, “the child maintenance service doesn’t seem to be doing its job in recent years.” This only adds to the angst and frustration that single parents feel towards the government.

However, amidst all this chaos of financial pressures, and the stress of balancing her work and life, there have been aspects of being a single parent that Emma has come to appreciate. In the process of falling and getting back up again and again when all the odds were against her, she claims to have learned the value of things in life. Other people who are relatively well-off, financially, may not worry about travel costs or may end up wasting a lot of things. For the reason of such things being readily available to them, they fail to quite understand their value.

Through her ‘thrifty’ lifestyle, Emma has gained a different perspective towards life and the hard work of single parents: “I have realised that you don't have to have lots of material things to make things nice. We buy everything second hand, mostly furniture. But when we find something nice, we really appreciate it.” As a result, her children have also grown up with these precious lessons of appreciating all that comes with hard times.

I asked Emma about how single parents cope with the pressures alone. “I think connecting to single parents is very important. Like other people who are in the same boat, we share a lot of knowledge and support for each other. They are like family for me, really. I think that without those people, it would be very hard. You must know other single parents.”

Meeting people who carry the same worries as you, acts like a candle in a dark room with no windows. While sharing their burdens, these single mothers get a sense of familiarity, a sense that maybe they are not all that alone and that others understand their troubles. Emma noted an instance of how whenever one of her sons was sick, a friend of hers would help her out and take her other child to school while Emma stayed at home to take care of the sick one. “You can’t do both things alone.” This one line of Emma’s encapsulates the many other troubles she and other mothers like her cannot overcome without each other’s help.

Emma also expressed her views on this whole ordeal as a clinical psychologist because there is an obvious strain on the mental health of these parents. “We are often so busy, we don't have time for friendships, so we get lonely. We have a lack of social support and I think all these things can really have an impact. What I wish now is that I had a coach, someone to coach me and go - you are in a position of scarcity. You need to stop and slow down and take your time.”

While reminiscing about the harder days, Emma wonders about the decisions that she took and that if she had somebody to guide her through it, she may have done things in a better way.

Since 2012, the Hackney Food Bank has been working towards providing help and support to people who are in crisis. They do this by supplying emergency food parcels and other essentials, which offers immediate relief in times of crisis. They also help to connect people in need with appropriate local organisations that can help to address the root causes - an effective and more feasible solution to deal with large number of people.

Pat Fitzsimons is the CEO of Hackney Food Bank and has held the post for nearly two years now. I spoke to her regarding the cost of living crisis and how single mothers are disproportionately affected by it. She told me that a lot of single parents - majority being women - visit her organisation to get emergency food parcels. Pat shared the relevant statistics which clearly indicated a sharp increase in the number of single parents who sought help from Hackney Food Bank.

|

2022 |

2023 |

YOY |

|

|---|---|---|---|

|

January |

70 |

136 |

94% |

|

February |

95 |

171 |

80% |

|

March |

128 |

201 |

57% |

|

April |

95 |

191 |

101% |

|

May |

124 |

198 |

60% |

Table showing the year-on-year increase in the number of single parents. Data Source: Hackney Food Bank

“Single mothers naturally earn less in contrast to two-parent families. There is just one person in the household who is possibly working,” said Pat while disccusing the issue. She added: “Single mothers with more than two children suffer the most. They lose their benefits for the third or subsequent children. Housholds with more than two children get penalised financially.” This is because of the two-child benefit cap introduced by the UK government in 2017, which prevents families from receiving any additional benefits - Child Tax Credit or Universal Credit on the third or subsequent children.

Pat went on to provide me with three case studies for my investigation.

Julia, 25

Two and a half years ago, Julia left her home in Spain, fleeing a violent relationship and started a new life in London. She got a job working for a rail company and earned enough to be self-sufficient. She and her friend took turns looking after each other’s young children while the other worked. But when her contract finished in December, her friend went back to Spain and she found herself alone and without enough funds to get by. She receives Universal Credit for her and her three-year-old but it is not enough to cover the basics. Not being able to speak English well, she’s struggled to make friends here and cannot afford nursery costs. She and her three-year-old daughter are extremely isolated. Hackney Food Bank has been supporting Julia with emergency food parcels and signposting her to agencies which can help reduce the isolation, offer counselling, and help her sort childcare.

Speaking through a translator, Julia, 25, said: “Until I can sort childcare for my daughter, I cannot go back to work. I feel stuck. My family in Spain cannot support us – we would just be extra mouths to feed and my first boyfriend there was abusive – I cannot be near him. I don’t want to go back there. Before I came to Hackney Food Bank, there were days when I went hungry so my daughter could eat. I do feel depressed. It is difficult being in a country where everyone speaks the language but me – I don’t have any friends and I can never go out because there is nobody to look after my daughter. Compared to what has happened to me before, things are better – the food bank staff are so kind to me. I want to learn English and look for a job – I love cooking or would be a good carer or a waitress.”

Kat, 45

Kat worked in retail but was made redundant just before the pandemic. The single mum of two has an eight-month-old girl and a 21-year-old son. She is on Universal Credit but it is not enough to cover even the basic living costs. She regularly skips meals and rarely has treats. “I cannot go back to work yet because childcare is so expensive. I do everything I can to help my daughter learn and develop – I take her to drop-in centres, swimming and the library. She only has a few toys but I make sure she has food, play, interaction and stimulation – I’m determined to get it right. I often just have a piece of toast or cereal for dinner. I struggle to pay for the basics – nappies and wipes are so expensive. Everything has gone up in price. Universal Credit is rubbish – it just isn’t enough. The first time I came to the food bank I felt embarrassed but you soon realise lots of us are having the same struggles.”

Magnata, 46

Magnata is trained in property management and civil engineering but works part-time as a retail assistant because it allows her to look after her young children. She used to live in Lewisham but was re-housed by the Council in Islington in a small flat that costs more than £1,700 per month. Her benefits no longer cover all the rent and the small amount she earns has to make up for the shortfall and cover living costs. The father of two of her children is an asylum seeker and is waiting for his application to live here to be approved. Meanwhile, he is unable to live with his family. She said: “I’m looking for another job and I would like to move somewhere cheaper. My salary and Universal Credit are not enough to pay the rent and the bills, let alone food. I cannot work in my field of civil engineering because the hours are too long and I need to be around to look after the children. My hair is falling out because of the stress.”

A kitchen for all

I was taking some pictures outside the Hackney Food Bank when a gentleman approached me. “What are you clicking these pictures for?” he asked with a huge backpack on his shoulders and a face full of curiosity. “I am a journalist. A story I'm doing on single mothers has brought me here,” I replied. In the flick of a moment, his curious face turned very happy. “There is a friendly community kitchen down this road and I am sure you will discover some good stories there. I am heading there, you wanna join?” asked the man who was a stranger to me a couple of minutes ago. As a journalist, you never really say no to such opportunities. Without much thought, I said yes and we started our walk towards Idia’s Community Kitchen.

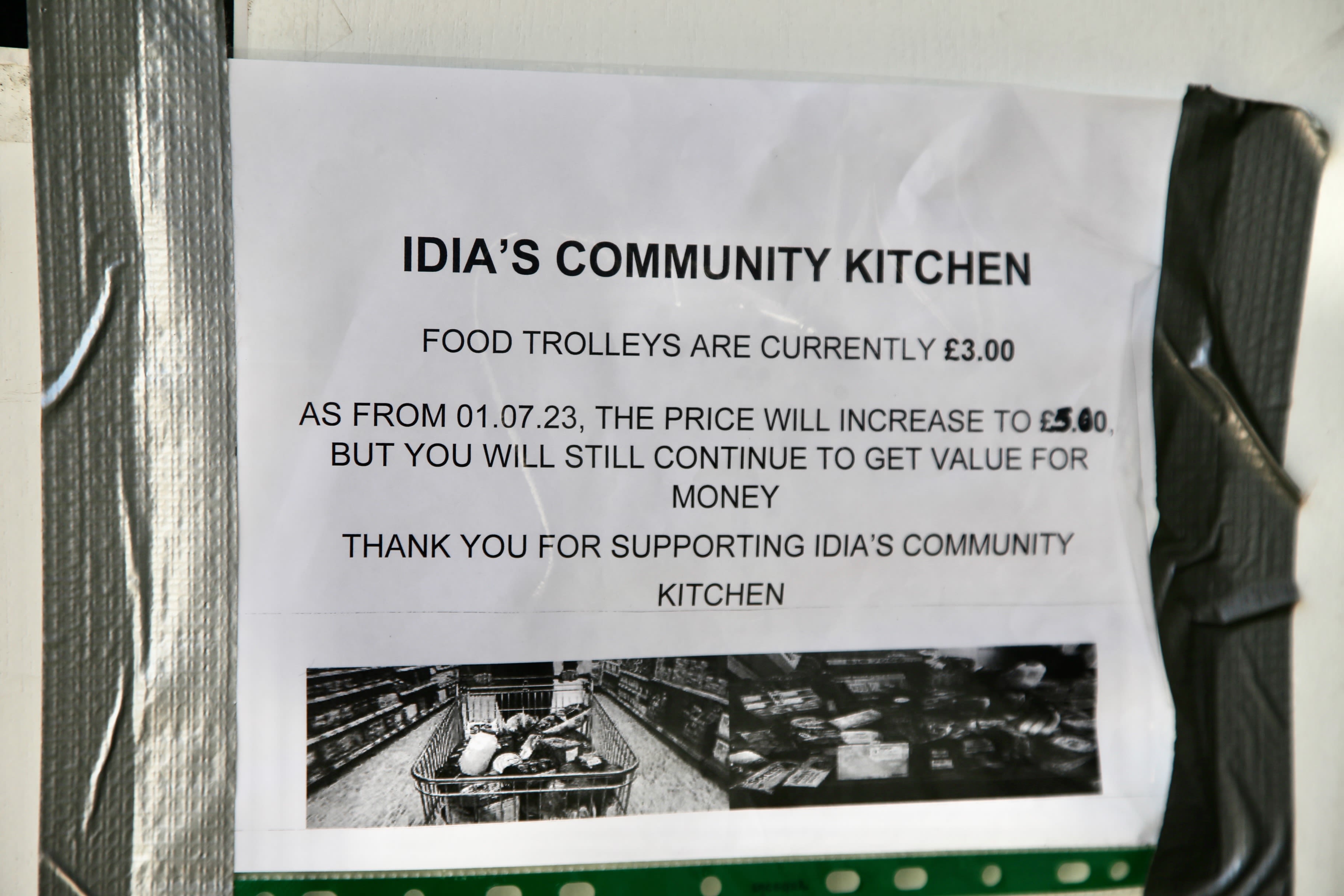

In the middle of the Hackney social living is a small community centre known as Fellows Court where Aina runs a homely kitchen for anyone in need. She started this initiative in memory of her late daughter Idia, who passed away due to a life-threatening disease at the age of 12. “Idia was a kind and compassionate soul - she would often share her meals with strangers if they were in need. After she succumbed to the disease, the only way to pay tribute to her was to carry on her goodwill and kindness, and that is when I started Idia’s Community Kitchen,” said Aina as she talked about her journey.

Aina’s kitchen is open to anyone and everyone in need. Unlike other charities that supply groceries and hot meals on a referral basis only, Aina is fully focused on just helping people out as much as she can. Her kitchen works in partnership with supermarket giants like Tesco and Co-op where she gets most of the unsold groceries and other meals. She then cooks hot meals almost every day of the week and sells the grocery items at £5 for each trolley. When I asked her about the reason behind putting up the price tag, she gently smiled and replied: “Value. One must always value and respect food. I can give them away for free, after all, that is what charities and support groups do. But paying a small amount, as little as just £5 makes a person value it, they will not just throw it away because they paid a price for it.”

While we were speaking, Aina continued her cooking for the day. She was making around 150 meals for distribution at the Strand. I asked about single mothers who visit her kitchen. “We do receive a lot of single mothers, and most of them come here for their weekly groceries.” I asked Aina about the struggles of being a single mother in this day and age. “It is very difficult. Single mothers have to make some extreme decisions to sustain, and the dilemma that is caused in the process taxes out everything they have, be it mentally or physically.”

Aina highlighted two main aspects of the struggles, the major one being finance. She spoke about the different experiences she has heard about in the kitchen - how single mothers often have to work double or even triple shifts, but still cannot afford to pay for all the bills and expenses. “The wages of many single mothers that come here are not enough to cover all their needs. They have got bills to pay for, they have got packed lunches to pay for, after-school activities to pay for, and then they have social aspects of life too, like the internet and mobile bills and maybe a holiday somewhere. Sometimes you want to go to a beach or go watch a movie. All this is a lot of financial constraints on a single mother,” said Aina. She described how the biggest share of heat is faced by mothers with infants. These women have no choice but to quit working and look after their babies. While Universal Credit is barely enough to cover their bills, these mothers have to then resort to food banks and such community kitchens to meet food and other basic necessities.

Aina also stressed the dilemma that these single mothers have to face while choosing between two necessities and how they struggle emotionally as they prioritise one need over another. “Should I buy food or should I pay for the gas? Should I keep the heating on or should I buy some snacks for my kids? This should not be the case in a country like this. This is the Great Britain,” said Aina while recounting a conversation she had with a single mother.

Another aspect of single parenting that Aina puts great emphasis on is the child’s upbringing. Due to the soaring prices of childcare, these single mothers cannot put their children in nurseries and créche services while they go to work, and as Aina told me in the interview, some of them have to work double and triple shifts to make ends meet. While they are out for work, their children are generally on the streets with no supervision. These kids often fall prey to the wrong company and acquire wrong habits like hatred, and violence to name a few. Aina showed me a version of reality that I did not imagine existed. After speaking to her, I asked if I could come again to meet a few single mothers who visit her kitchen. She told me that a few of them come on Fridays to get their weekly groceries, and I can visit them and speak to them.

Old mother, new mother

The next Friday, I went to the kitchen with a lot of questions on my mind. As soon as I stepped inside the place, a very humble lady welcomed me and asked, “Honey, are you hungry? Would you like some buns and coffee?” This is Urshala. A single mother herself, she has been voluntarily working at the community kitchen for a few years now. 65 years old Urshala separated from her husband when she was a young mother.Raising six kids while bearing all the parental responsibilities was a big burden on her shoulders. Coming from a partially educated background, Urshala found it extremely difficult to understand the world of finance and budgeting. “Finance is a difficult part of our lives because of lack of knowledge. We don't know how to manage our money. We don't have enough information on how to spend our money, and we end up spending the money anyhow on unnecessary stuff,” said Urshala while addressing the pressing issue of lack of financial education amongst single mothers from marginalised communities. Raising a single child in a global city like London can be very expensive, let alone bearing the responsibilities of six of them.

On Urshala’s worst days, she ended up skipping multiple meals, just so she could manage to provide food to her children. “Sometimes I did not eat for three days. Sometimes I was up all night figuring out how to arrange breakfast for my kids the next morning. It was difficult and I had no support.” Urshala’s former partner had no involvement in their children’s upbringing. She could not find any external support, and she now blames her lack of awareness and self-confidence for not being able to seek help from other people and organisations. “The most heartbreaking thing is when you do not know where to go and ask for help.” Urshala stressed how important it is for single mothers from marginalised communities to gain knowledge about personal finance and budgeting. She feels that extending unconditional support is the only way to boost their self-confidence and help them overcome their failings. She now works as a full-time volunteer at Aina’s Kitchen. During her free time, she tries to learn more about finance-related stuff, so that she can teach other people who are in need.

While speaking to Urshala, I noticed another woman looking at us from a distance. When I asked about her, she turned out to be a single mother in her early days of parenting. I approached her and tried to speak to her, but she seemed a little hesitant. Perhaps because of my bulky camera setup. Quickly, I turned my camera off and put it away. Things were different now, she was more comfortable. While she agreed to speak to me, she wanted me to maintain her anonymity. “How do you feel being a single mother?” I asked. “Being a mother is an amazing feeling - something that I always wanted to have. But being a single mother with no other source of support feels lonely.” This woman, who recently became a mother, used to work at a food retail shop. She had to quit her job after she gave birth to her daughter, and has been living off of her Universal Credit ever since. However, the amount she receives barely manages to keep the rent and bills going. Before coming to the community kitchen, she struggled to feed herself because of her infant’s expenses. She now comes to Aina’s kitchen regularly where she gets some hot meals for herself and a few basic supplies for her daughter. She pays a subsidised price of £5 to get her weekly groceries from this kitchen.

However, there are times when she struggles to collect even those £5.

These stories tell us about the silent battles single mothers fight each day to sustain their lives, let alone make them any better.

Carly’s story brings forth the issue of expensive childcare services and how she struggled to find an affordable place to live because of her single mother’s status.

Emma’s first-hand account sheds light on the issue of stagnant income in the age of inflation and how she always ended up with little-to-no money in her savings account, creating a sense of insecurity at times of emergency.

Aina talks about how single mothers with low incomes find it extremely difficult to make ends meet and how sometimes even gathering the basic necessities of life can turn out to be challenging.

The struggles of single mothers are multi-faceted, and the most crucial challenges they face in this day and age are:

Financial Instability

Grappling with limited money is the biggest challenge that single mothers face. Their commitment towards raising the children during the initial years of motherhood often narrows down their scope to earn better, adding more to their financial burden. A survey conducted by the Young Women’s Trust reported that around 51% of young single mums are "filled with dread" at the state of their finances. More than half said they sometimes go hungry to feed their children on time.

According to a Living Cost and Food survey carried out by the Office for National Statistics (ONS), single-parent families’ disposable income stood at £414.20 a week. On average, 87% of this income (£356.80) went into essential household expenditure, leaving them with just £57.40 as remaining funds each week. This amount was almost five times more for two-parent households. Single-parent households in the UK - 90% of which are headed by women - only have one potential earner because of the responsibility of caring for their children.

This naturally results in lower disposable income compared to two-parent households having at least one full-time employee. On top of it, these single-parent households have also seen a consistent increase in their bills. The inflation in food prices is currently at a 40-year high and is expected to only increase in the coming months. Data provided by ONS reports that the annual rate of UK food and non-alcoholic beverage prices inflation increased to 19.1% in the 12 months to March 2023. On the other hand, the price of electricity has risen by 40.5% and the price of gas by 66.8%. With such hikes in food prices and energy bills, single parents - especially single mums, are finding it more than difficult to sustain with these expenses. These households then have to resort to additional credit and loan services, which in turn, puts them in a vicious cycle of debt.

Lack of Affordable Housing

The cost of renting and owning a house has increased significantly in the UK. Between August 2021 and August 2022, the average price of a house has gone up by £36,000 - reaching £296,000. Especially in England, the average price has increased to £316,000, which is a 14.3% rise in the same period. According to the Office of National Statistics (ONS), full-time employees are expected to spend 9.1 times their workplace-based annual earnings when purchasing a home in England.

Private rental prices in the UK rose by 5% in the last 12 months, according to the ONS. London is the worst-hit city - with annual rental prices increasing by 5.1% in 12 months to 2023, above the average England price. The English Housing Survey conducted by the Department for Leveling Up, Housing and Communities (DlUHC) concludes that around a quarter of private as well as social renters are finding it either fairly or extremely difficult to afford the rents.

Research carried out by IPSOS in the UK further suggests that 54% of renters are worried about their ability to pay the rent on time. All this data is enough to conclude that the affordability levels of renting or owning a place in the UK are going down sharply. This has severely affected single mothers - on top of increasing food prices and energy bills, making it even harder for them to sustain. The shortage of affordable housing has pushed almost one in every three lone mothers either into arrears with rent or a constant struggle to keep their homes.

The rising cost of childcare services

Childcare is an essential service - both for a child and especially for working single mothers in their initial years of motherhood. It helps to create an environment for the all-round development of the child while providing an opportunity for a single parent to go out for work. However, in the UK, childcare services have a significant effect on the disposable income of households due to their extensive costs, causing an immense financial burden. An analysis conducted by the Business in the Community (BITC) found that on average, an adult earning a median wage spends around 65% of their after-tax income on full-time childcare.

The BBC reports that the average annual cost for a full-time nursery place for a child under two years of age is £14,836 in the UK. It also highlights a report by charity Coram which concludes that the costs for childcare services have increased by 5.9% in 2022. An enquiry conducted by the UK government’s Education Committee reports that 97% of households believe that childcare is too expensive. Single mothers who are unable to afford such expensive childcare are then forced to leave their existing jobs - leading to a reduction in income and an increase in financial constraints.

Lack of mental support

Every parent wants to be their best self for their children. For them, ideally, there is no room for failure in this aspect. This is especially the case for single parents since they don’t have anybody else to fall back on if they fail or fall short of what is expected of them. Such pressure to be their perfect self all the time, not having anybody to talk to about their problems, and always having to put up a strong front often leads to mental health problems. A survey conducted by Mental Health Foundation suggests that 31% of single parents felt anxiety due to loneliness, 39% due to debt, 36% felt anxious about paying the bills, and 20% of single parents were worried about housing. These single parents, 90% of which are women, often have to hide their mental health problems because society is quick to question their parenting abilities. They already feel looked down upon and stigmatised for being a single mother, and then having shame thrown on them because of the mental pressure that society itself pushes on them, is just adding insult to injury. Such devaluation discourages these women from ever coming out and speaking up about their issues.

While I was able to meet these women, hear their stories, and put them out in public, there are innumerable single mothers who are quietly struggling every day. My aim was to bring out the challenges in these women's lives to the furthest extent and shed light on the strength they demonstrate. With this story, I hope to inspire more empathy, support, and understanding towards this beautiful community.

It is important to uplift single mothers; for they are the society's pillars of strength and resilience.